Indigo Credit Card Qualifications

The Indigo Credit Card is open to applicants with bad credit. PAN Card Last 01 month Salary Slip Company Identity Card For Self Employed.

Indigo Hdfc Credit Card Points Features How To Apply Conde Nast Traveller India

In fact some cards start with credit limits of 200 minus the annual fee.

Indigo credit card qualifications. No Impact to Your Credit Score. You can pre-qualify for this card without worrying about hurting your credit score even more. 0 99 annual fee.

The Indigo Platinum Mastercard offers consumers with poor credit the opportunity to use a credit card for everyday spending. So while youll get the average credit limit right away without a deposit you might find your progress inhibited a few months down the. The credit limit goes only as high as 300 and possibly lower due to fees.

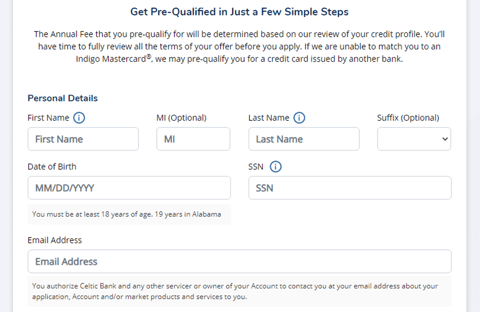

0 99 annual fee. Pre-qualifying now gives you a chance to review your offer without impacting your credit score. Our pre-qualification process does not affect your credit score.

Online servicing available 247 at no additional cost. Account history is reported to the three major credit bureaus in the US. While that limit may seem small if youre looking for more spending power its on par with most credit cards for bad credit.

Take pride in your progress and let Indigo Platinum propel you forward. Pre-qualification is quick and easy and if you have the credit profile needed you might be able to secure a credit card with no annual fee. The issuer will not take your credit score into consideration for a higher limit as everyone starts at the same amount.

Your score does not have to be 611 to qualify. By delivering a straightforward opportunity to build and access credit the Indigo Platinum card enables you to meet your everyday needs. Even if you have a bankruptcy on your file or have no credit history at all you can still.

To take advantage of all our site features we recommend that you upgrade your current browser or download one of the following optional browsers. You can qualify for the card. For any assistance please call our customer service helpdesk at 91 0124-6173838 from 9 am to 6 pm.

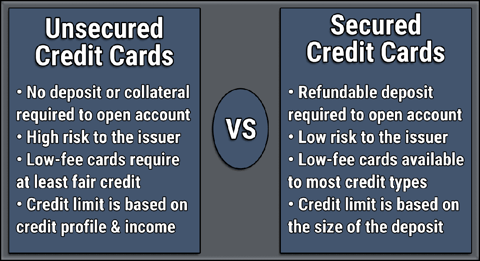

Unsecured credit card no security deposit required. While pre-qualification indicates that you have high odds of approval it doesnt guarantee it. This is based on the information you give and other credit cards you have.

The most noteworthy perk of this card is that it is unsecured meaning that you wont have to make any deposits prior to getting the card and using it. For an account that charges a 59 annual fee for example your credit limit might initially be 241 because the issuer. Indigo reports the account history to the three major credit bureaus in the US enabling credit cardholders to build credit scores with every purchase.

The Indigo Mastercard represents one potential achievement on your journey to successfully managing your credit. Furthermore if your FICO score is close to or higher than 677 then your chance of approval may be even greater. Personal Identity and Address Documents for eg.

That gives the issuer the freedom to extend credit to consumers with worse credit than it otherwise would. Plus the Indigo Platinum card does not specify any timeline for an account review to increase your credit limit. Complete our Pre-Qualification form and our CardConnnection tool will determine if you are pre-qualified based on your credit profile.

Less than perfect credit is okay. Our pre-qualification process does not affect your credit score Keeping your account in good standing may help establish andor improve your credit 247 access to your account even on mobile. Our Bottom Line.

Credit utilization matters with every issuer. Customers with worse credit will pay a higher annual fee to compensate the issuer for the additional risk. You may have a 700 credit score and max out your cards one month and you will not receive this card.

Its designed as a credit building unsecured card which reports to all three major credit bureaus. A FICO credit score of 615 is recommended for a higher chance of approval but this is not required. Rember Indigo Platinum Mastercard is a starter credit card which applies to all Indigo Mastercard variations.

Keeping your account in good standing may help establish andor improve your credit. The credit guidelines for approval are less strict than comparable credit cards. Browser Upgrade - Indigo Platinum MasterCard.

The Indigo Credit Card requires you to pre-qualify before officially applying. Since this is a card for good credit there may be a strict standard for qualifications including credit record and income level. 247 access to your account even on mobile.

Easy pre-qualification process with fast response. This card has a very poor approval or acceptance rate. Using your outdated browser will prevent you from accessing many features on our website.

Indigo Platinum Mastercard holders are not required to provide a deposit to secure the credit line. Driving Licence Voter ID Passport Aadhar Card etc Income Documents Salaried Individuals. No security deposit requirement.

The Indigo card credit limit is 300 for all new cardholders. The Indigo Credit Card is targeted towards consumers who have poor credit. Indigo will make a soft inquiry into your credit history leaving your credit score.

The Indigo Mastercard is issued by Celtic Bank a Utah-Chartered. The initial credit limit of 300 is standard for a credit building card but is still pretty low when it comes to boosting your credit score. You dont have to have an excellent credit score to qualify for any of these cards.

Based on the FICO score recommendation applicants should have a recently clean credit record with no recent negative marks on their report. Your application will still be subject to credit approval if you apply for an Indigo card. Protection from fraud if your card happens to be lost or stolen.

You can check if you are pre-qualified on the cards website without affecting your credit score. Our website has detected that you are using an outdated browser. Forget about meeting some minimal requirements because the issuer considers every pre-qualification application.

You will start out with a low limit then after about 1 year a credit limit increase. However the card issuer may expect limited discrepancies. Form 16 Track your application status by logging in to your IndiGo account.

Indigo Credit Cards Applynowcredit Com

Indigo Mastercard Apply For A Credit Card Now

Www Indigoapply Com Apply For Pre Approved Indigo Platinum Mastercard Credit Cards Login

Indigo Platinum Credit Card Review 2021 Finder Com

10 Market S Top Credit Cards For A 600 Credit Score

Indigo Credit Card Login Www Myindigocard Com Login Payment 2 Credit Card Visa Card Secure Credit Card

2021 Indigo Card Review Credit Limit Application Details Badcredit Org

Www Indigoapply Com Apply For Indigo Credit Card Faqs And Reviews

Indigo Platinum Mastercard Apply Online Creditcards Com

Indigo Card Indigo Platinum Mastercard Credit Card App Improve Credit Score Cards

Indigo Platinum Mastercard Info Reviews Credit Card Insider

First Premier Bank Mastercard Review Credit Com

Indigo Platinum Credit Card Reviews 2 200 User Ratings

Opensky Secured Credit Visa Card Reviews August 2021 Credit Karma

2021 Indigo Card Review Credit Limit Application Details Badcredit Org

6e Rewards Hdfc Bank Indigo Credit Card Eligibility

Successfully Build And Manage Your Credit With An Indigo Platinum Mastercard Tons Of Cards

Indigo Unsecured Mastercard Unsecured Credit Cards Money Saving Plan Credit Card Design

Www Indigoapply Com Apply For Pre Approved Indigo Platinum Mastercard Credit Cards Login

Post a Comment for "Indigo Credit Card Qualifications"